If the structural reforms included in this legislation had been enacted by July 1, 2021, the snapshot date for this year’s edition of the State Business Tax Climate Index, Idaho would have ranked 15th overall, 13th on individual taxes, and 27th on corporate taxes, improving upon its previous rankings of 17th, 20th, and 29th, respectively. It would also be the third round of rebate checks to be issued in that time. Rates since May 2021, further reinforcing Idaho’s standing as a leader in pro-growth tax reform over the past two years. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. If enacted, this will be the third time Idaho policymakers reduced individual and corporate income tax A corporate income tax (CIT) is levied by federal and state governments on business profits. House Bill 1 would move Idaho to a flat income tax structure, reduce the rate from 6 to 5.8 percent, exclude an additional $2,500 (single filers) or $5,000 (joint filers) from taxation, and issue another round of income tax rebate checks-all while increasing annual funding for education. Reform and relief legislation that would return surplus revenue to taxpayers while making the state’s tax code more economically competitive. Idaho Governor Brad Little (R) has called a special session for September 1, 2022, to consider another round of tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. On November 8, 2022, voters approved this legislative action with an advisory ballot measure.

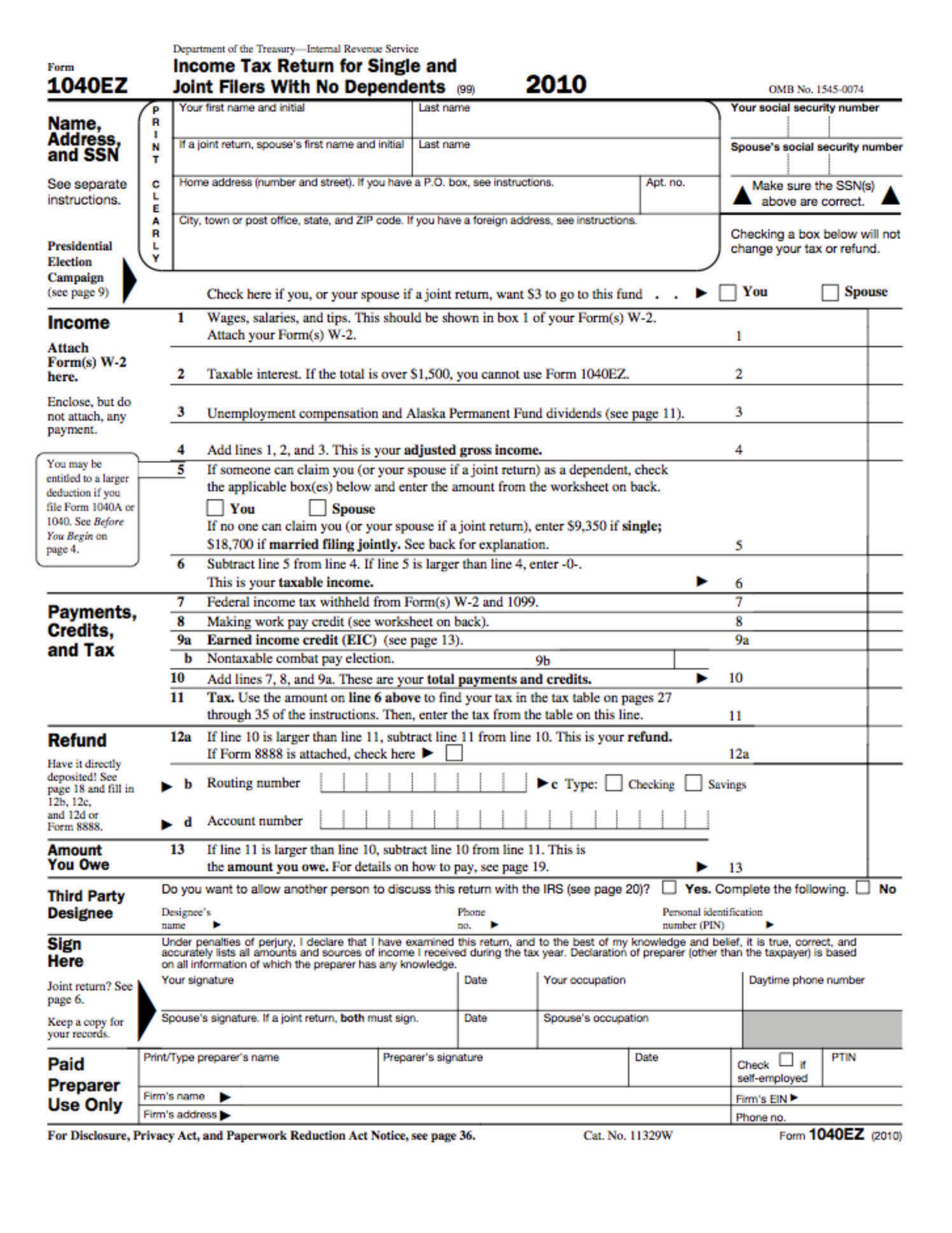

Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment.

imposes a progressive income tax where rates increase with income. 1, 2022, making Idaho the fifth state since June 2021 to enact legislation moving to a flat individual income tax An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. Update: House Bill 1 was signed into law on Sept.

0 kommentar(er)

0 kommentar(er)